In the competitive world of insurance, standing out and attracting the right clients can undoubtedly be a challenge. However, as an insurance agent, having a solid marketing strategy is essential. Not only does it help you generate leads, but it also enables you to build lasting relationships with your clients. Whether you’re just starting out or looking to enhance your current efforts, implementing the right marketing approach can truly make all the difference.

In this blog, we will explore three proven marketing strategies that can help you elevate your business, expand your reach, and ultimately establish yourself as a trusted insurance agent. So, if you’re ready to take your marketing game to the next level, let’s dive right in!

Start Building Your Funnel Today for Free

Traditional Marketing vs. Agile Marketing for Insurance Agent

Before diving into specific marketing strategies, it’s essential to understand two contrasting approaches to marketing: traditional marketing and agile marketing. Each offers distinct methods for promoting your insurance business, so let’s explore how they differ and which might be the better fit for your needs.

What Is Traditional Marketing?

Traditional marketing follows a linear, one-shot process:

- Conceptualize the Campaign: You brainstorm and plan a marketing initiative.

- Develop in Isolation: The campaign is created internally, without input or feedback from your target audience.

- Launch and Hope for Success: The campaign is rolled out in a single, high-stakes event—commonly referred to as a “Big Bang Launch.” It either delivers results or fails entirely.

While this approach was highly effective in the pre-digital era for reaching broad audiences through TV, radio, and print ads, it comes with significant risks. The success or failure of the campaign hinges entirely on predictions and assumptions made before the launch.

What Is Agile Marketing?

Agile marketing takes a more iterative, flexible approach:

- Start with an Idea: You begin with a concept for a campaign, just as you would in traditional marketing.

- Test the Minimum Viable Campaign: Instead of investing heavily upfront, you develop a scaled-down version of your idea. This “minimum viable campaign” allows you to gather audience feedback with minimal investment.

- Analyze and Adjust: You monitor the campaign’s performance, collect data, and make adjustments based on what you learn.

- Iterate and Optimize: You continue refining and improving the campaign in cycles, treating it as an ongoing project rather than a one-time event.

This method allows marketers to test concepts, reduce risk, and continuously optimize campaigns for better results.

Which Approach Should You Choose?

The traditional marketing model was a natural fit in the pre-digital era when businesses relied on mass media to reach consumers. However, it’s a high-risk approach in today’s fast-paced, data-driven marketing landscape. A campaign developed without audience feedback may fall flat, wasting both time and money.

In contrast, agile marketing aligns perfectly with the tools and insights available in the digital age. By testing ideas on a smaller scale, you can:

- Validate your assumptions early.

- Optimize campaigns for better performance.

- Gradually scale successful campaigns with confidence.

Agile marketing acknowledges that marketing is a skill—one that requires experimentation, learning, and, yes, making mistakes. Losses are inevitable when learning the ropes, but the agile approach helps minimize them. Testing ideas incrementally reduces the financial impact of failures, ensuring that setbacks don’t derail your business.

While even small losses can sting, agile marketing offers a practical way to learn and grow without risking everything on a single campaign. It’s about learning from data, adapting quickly, and setting yourself up for long-term success.

Now that we’ve covered the foundations of these two paradigms, let’s explore the three best marketing strategies for insurance agents to grow your business effectively.

Insurance Agent Marketing Strategy 1: Leverage the Power of Google Search Ads

Google Search Ads are one of the most effective tools for insurance agents to connect with potential customers. These ads appear prominently at the top of Google’s search results, which makes them a prime opportunity to capture the attention of people actively searching for insurance solutions. Now, let’s explore how to make the most of them:

Target the Right Keywords

- Transactional Keywords: Focus on keywords that indicate immediate intent to purchase, such as “car insurance quotes,” “affordable health insurance,” or “life insurance near me.” These are used by people who are already prepared to make a decision, allowing you to tap directly into their buying journey.

- Informational Keywords: Don’t overlook keywords from users researching insurance-related topics, like “how does life insurance work?” or “best home insurance for new homeowners.” While these searches may not result in immediate purchases, they offer an opportunity to build trust and establish your brand as a knowledgeable resource.

Drive Traffic to High-Performing Pages

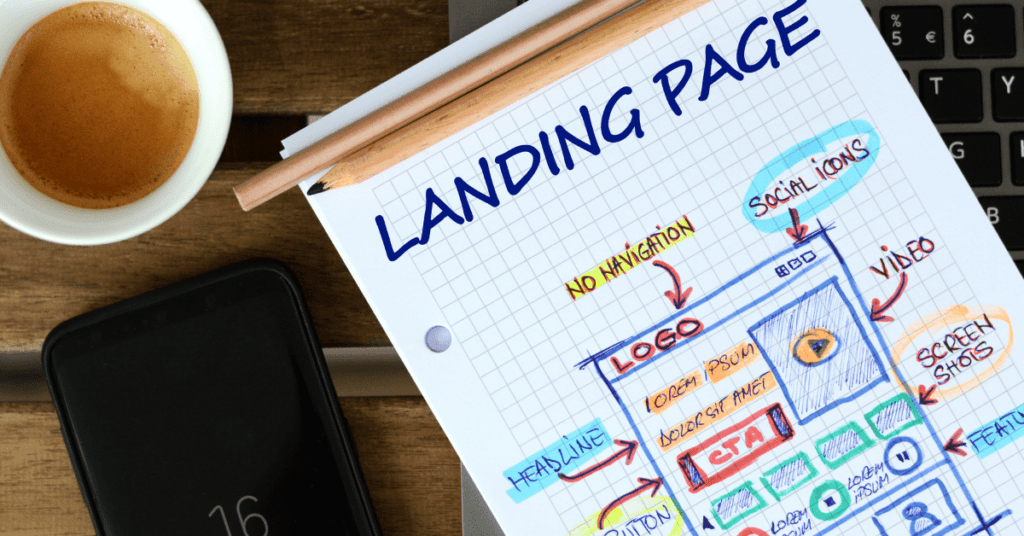

Getting clicks on your ads is just the first step—what happens after that is critical. The landing pages you use should function as strategic entry points into your sales funnel. Here’s how to maximize their effectiveness:

- Answer Their Questions: Provide the information users were searching for upfront, whether it’s coverage options, pricing details, or educational resources.

- Guide Them Into Your Funnel: Incorporate a clear call to action, such as completing a short survey to receive a custom quote. This interactive step—commonly known as a quote funnel—creates a personalized experience that can increase the likelihood of converting visitors into leads.

Google Search Ads allow you to connect with customers at the moment they’re expressing a need. By targeting the right keywords and driving traffic to well-optimized landing pages, you can capture high-intent prospects, build credibility, and guide them toward becoming paying customers.

When done right, these ads don’t just bring clicks—they deliver qualified leads who are already one step closer to saying “yes” to your insurance products.

Insurance Agent Marketing Strategy 2: Unlock the Potential of Social Media Ads

Social media advertising offers a powerful way for insurance agent to reach and engage with their ideal customers. Major platforms like Facebook, Instagram, Twitter (X), LinkedIn, YouTube, and TikTok provide sophisticated ad-targeting capabilities that allow you to tailor your campaigns to reach the right audience. Here’s how to leverage social media ads effectively.

Leverage Advanced Targeting Options

Social media platforms enable highly precise targeting. Depending on the platform, you can use:

- Demographic Criteria: Target users by location, age, gender, education, occupation, and more. For example, you could focus on homeowners in specific ZIP codes for home insurance campaigns or recent college graduates for health insurance plans.

- Psychographic Criteria: Go deeper with interests, hobbies, lifestyle preferences, religion, political views, and other behaviors. These insights help you tailor your messaging to resonate on a personal level.

By narrowing your audience, you ensure your ads are shown to people who align with your ideal customer profile, increasing the likelihood of conversions.

Focus on Lead Generation, Not Direct Sales

Social media ads aren’t designed to directly sell insurance products—they work best as tools for building relationships and capturing leads. Instead of promoting your products, use ads to highlight lead magnets, such as:

- Free eBooks: “5 Essential Tips for Choosing the Right Life Insurance Policy”

- Free Tools: “Calculate Your Home Insurance Needs in Minutes”

- Webinars: “How to Secure Your Family’s Future with the Right Insurance Plan”

These lead magnets provide value upfront and encourage prospects to share their contact information, moving them into your sales funnel.

Once you’ve captured attention with a compelling ad, direct traffic to a high-converting landing page. The page should:

- Deliver the promised value (e.g., provide the free resource).

- Guide visitors toward the next step, such as scheduling a consultation or completing a quote request form.

This process ensures that every ad dollar spent has a clear path toward generating leads and eventually converting them into paying customers.

Start Small and Scale Smart

- Choose the Right Platform: Begin with the platform where your audience is most active. For instance:

- Use LinkedIn for targeting professionals or B2B insurance prospects.

- Choose Instagram or TikTok to connect with younger demographics.

- Leverage Facebook for a broad, diverse audience.

- Set a Small Daily Budget: Launch with a modest budget to test the waters without overspending.

- Analyze Results: Monitor which platforms and campaigns deliver the best results. Focus your efforts on high-performing campaigns.

- Scale Gradually: Increase your daily budget as you identify winning strategies. Once you’ve mastered one platform, apply your learnings to others using the same iterative, agile approach.

Social media platforms offer the opportunity for A/B testing, allowing you to experiment with different ad creatives, headlines, and offers. By regularly refining your campaigns based on performance metrics like click-through rates (CTR) and conversion rates, you can effectively maximize ROI.

Furthermore, social media ads give you the power to reach your ideal customers with laser precision, while simultaneously nurturing leads in a non-intrusive way. By promoting valuable lead magnets and driving traffic into your sales funnel, you can establish trust and build a pipeline of qualified prospects.

Ultimately, with a strategic, data-driven approach, social media advertising can evolve into a cost-effective and scalable pillar of your insurance marketing strategy.

Insurance Agent Marketing Strategy 3: Search Engine Optimization (SEO)

Search Engine Optimization (SEO) is a powerful long-term strategy that can help drive organic traffic to your website by improving your rankings on Google for targeted keywords. For insurance agent, SEO offers a valuable opportunity to connect with potential customers who are actively searching for information and solutions related to insurance. Here’s how you can make it work for your business.

Since Google is the go-to source for most people researching products and services, ranking high in search results—particularly in the top three positions—significantly increases your chances of getting clicks and attracting visitors. In contrast to paid ads, SEO traffic doesn’t come with a per-click cost, making it a cost-effective way to generate leads and build long-term growth over time.

Building a Niche Blog for SEO Success

Creating a niche blog focused on insurance-related topics is an excellent way to target your ideal customers. Here’s how to approach it:

- Identify Relevant Topics: Focus on topics that resonate with your audience, such as “How to Choose the Best Life Insurance for Families” or “The Benefits of Umbrella Insurance for Homeowners.”

- Perform Keyword Research: Use tools like Google Keyword Planner or Ahrefs to find keywords that align with your niche. Look for a balance between high search volume and low competition.

- Develop High-Quality Content: Aim to create articles that are more in-depth, engaging, and valuable than what’s currently ranking on the first page.

The SEO Process: Step-by-Step

- Keyword Research

- Use tools like Ahrefs, Ubersuggest, or SEMrush to identify keywords that your potential customers are searching for.

- Prioritize long-tail keywords (e.g., “best health insurance for families in Texas”) that are easier to rank for and highly specific.

- Competitive Analysis

- Analyze the top-ranking articles for your chosen keywords. Identify what makes them successful (e.g., structure, content depth, readability) and look for gaps you can fill.

- Content Optimization

- Write content that is better than the competition. Use tools like Clearscope or Surfer SEO to ensure your content covers all essential topics and keywords.

- Optimize for readability with short paragraphs, headers, bullet points, and visuals to make your content easy to digest.

- Publish and Build Backlinks

- Promote your articles by reaching out to relevant websites, participating in guest blogging, and leveraging partnerships to earn backlinks.

- Backlinks are crucial for ranking well, as they signal to Google that your content is authoritative and trustworthy.

Converting Organic Traffic into Leads

Driving traffic to your website is just the beginning. To turn visitors into leads and eventually paying customers:

- Use Lead Magnets: Offer valuable resources such as free guides, calculators, or consultations to encourage visitors to share their contact information.

- Exit-Intent Pop-ups: Capture potential leads before they leave your site by displaying a pop-up offering a free quote or downloadable resource.

- Content Upgrades: Add downloadable bonuses, like checklists or premium guides, to your most popular articles to increase engagement and lead generation.

SEO is a marathon, not a sprint. It often takes 12–18 months of consistent effort to see significant results. Focus on:

- Publishing high-quality, optimized content regularly.

- Aggressively building backlinks to strengthen your site’s authority.

- Continuously refining your approach based on performance metrics and emerging trends.

By staying committed, you can turn your niche blog into a reliable source of organic traffic and a key driver of your insurance business. SEO may take time, but the long-term benefits of consistent traffic and lead generation are well worth the effort.

Start Building Your Funnel Today for Free

Transform Visitors Into Loyal Customers Using These Proven Sales Funnels

Generating traffic is just the first step in growing your business. The real challenge lies in transforming those visitors into qualified leads and eventually into paying customers. Below, we’ll explore three highly effective sales funnels designed to help you achieve that transformation.

1. The Custom Quote Funnel for Insurance Agent

This funnel works wonders in industries where personalized solutions, like insurance, are essential. A tailored quote serves as the primary lead magnet, encouraging visitors to share their information in exchange for customized insights.

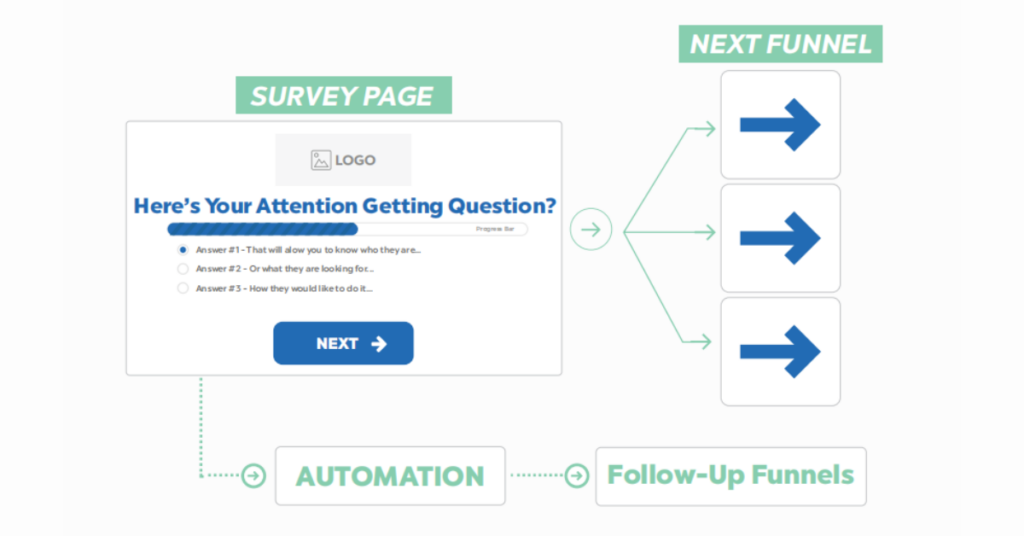

How it works:

Start by creating a survey page to gather all the essential details needed for a tailored quote. This initial step helps you understand the customer’s specific insurance needs or preferences, ensuring that the quote aligns perfectly with their requirements.

Next, transition smoothly to a squeeze page where you request the visitor’s email address. Collecting this information is crucial, as it allows you to deliver the custom quote directly to them, either through an automated system or manually, ensuring timely and personalized communication.

Once this is done, move on to a thank-you page. Take this opportunity to express sincere appreciation for their input and inform them when they can expect to receive their personalized quote. Not only does this add a professional touch, but it also enhances the overall customer experience.

Finally, once the quote is ready, send it via email. Include a compelling call-to-action (CTA) that encourages them to schedule a free 30-minute consultation. This consultation offers a valuable opportunity to address their needs directly. It will also move them closer to making a decision, ultimately increasing your chances of closing the sale.

Why it works:

People seeking insurance often crave clarity and customization, making this approach ideal. Leverage Google Search ads targeting relevant keywords like “custom auto insurance quote” and include an enticing CTA such as “Get a FREE Quote Today!”

2. The Squeeze Page Funnel for Insurance Agent

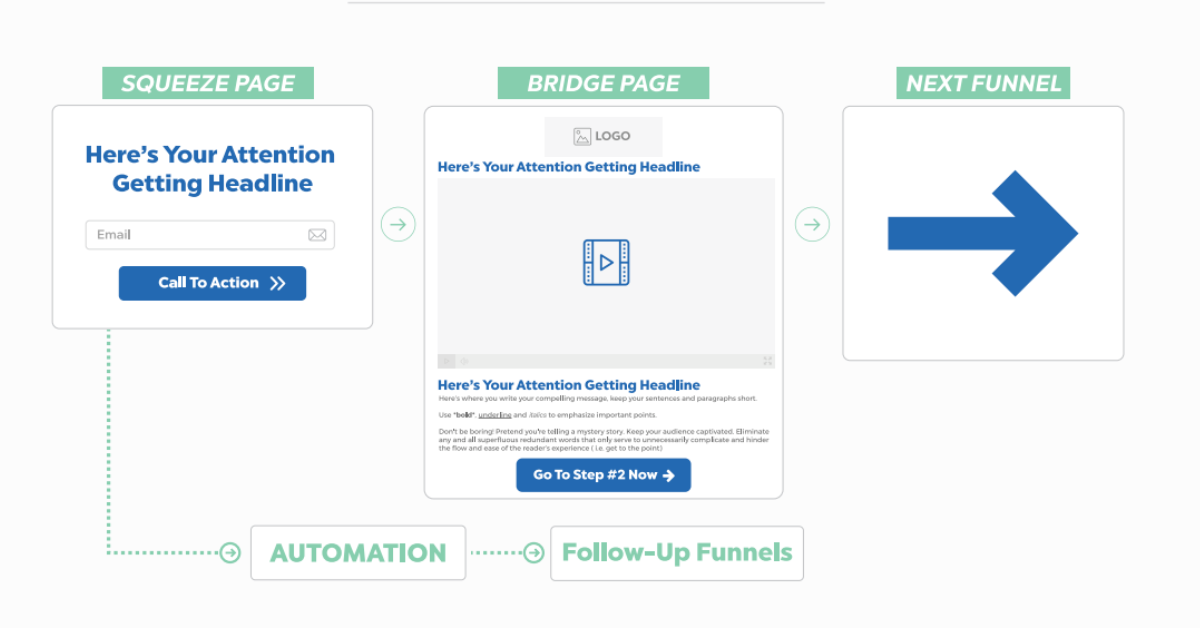

This classic and versatile sales funnel converts visitors into leads by offering valuable resources in exchange for their contact information.

How it works:

Start with a well-designed squeeze page where you present your lead magnet, such as a free guide, checklist, or template. Use this page to emphasize the value of the resource, clearly explaining how it will help visitors solve a problem or achieve a goal. Make sure to highlight the benefits and provide a compelling reason why they should download it. Then, ask visitors to submit their email address in exchange for access to the resource, keeping the form simple and easy to fill out.

After collecting the email address, redirect the visitor to a thank-you page. Express your gratitude for their interest and provide clear, easy-to-follow instructions on how they can access the promised resource. This step ensures that the lead feels valued and has a smooth, positive experience, helping to build trust and set the tone for future engagement.

Best Practices:

Your lead magnet should address a specific problem your target audience faces. For example, if you cater to first-time homebuyers, a guide titled “10 Steps to Navigating Homeowners Insurance” would be highly effective.

Promotion Strategies:

- Search Ads: Use Google Ads to target informational keywords like “how to get affordable homeowners insurance.”

- Social Media: Leverage platforms like Facebook and Instagram to run ads aimed at users likely to benefit from your resource.

- On-Site Placement: If your blog already attracts organic traffic, embed CTAs within high-performing articles. For instance, add an opt-in box at the beginning and end of a post discussing homeowners insurance.

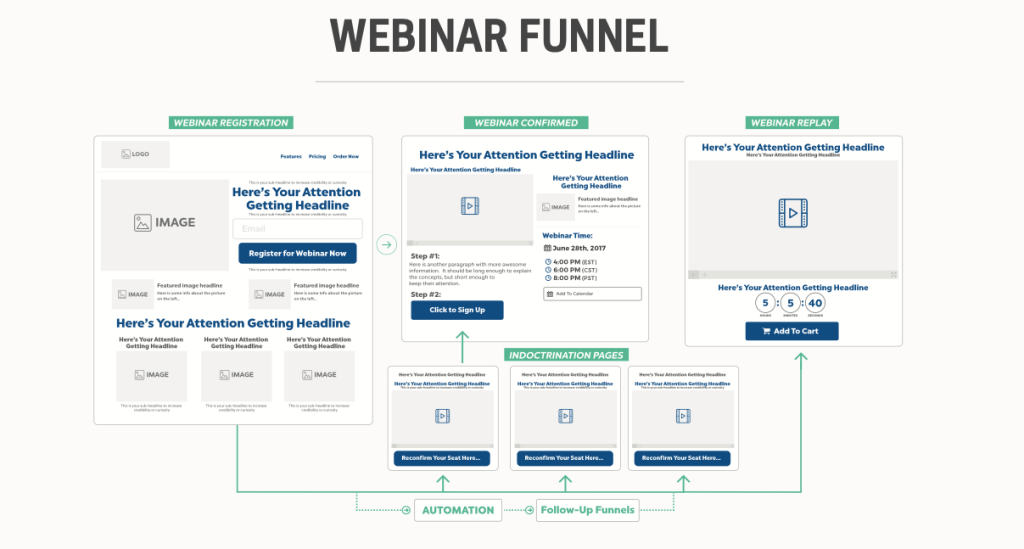

3. The Webinar Funnel for Insurance Agent

Position yourself as an authority in your field by hosting a live or recorded webinar that educates your audience and transitions them toward your offer.

How it works:

Start by creating an engaging webinar registration page that clearly highlights the topic and value of your session. Use compelling language to explain what attendees will gain from the webinar, focusing on how it will address their pain points or help them achieve their goals. Be sure to emphasize the specific benefits they’ll receive, whether it’s gaining industry insights, learning new strategies, or solving a particular challenge. Encourage visitors to register by providing their email address, making it quick and easy to secure their spot.

Once visitors register, redirect them to a thank-you page that confirms their participation. On this page, outline the webinar schedule, so they know when to tune in, and let them know that reminder emails will be sent as the event approaches. This will help ensure that they stay informed and ready for the session.

On the day of the webinar, direct attendees to the webinar page where they can access the live presentation or a recorded replay. During the session, focus on delivering actionable insights that provide real value and directly address the attendees’ specific needs. End the webinar with a strong sales pitch, showcasing how your product or service can solve their challenges and help them achieve their desired outcomes. This will increase the likelihood of converting leads into loyal customers.

Crafting Your Webinar:

Aim for a 45–60 minute session packed with value. Use the final 10 minutes to seamlessly transition into your offer. If the pitch feels awkward, try scripts like:

“I’m excited to share something with you that I believe will transform your journey. Would you like to hear more? Just type ‘Yes’ in the chat!”

If there’s little engagement, adjust your approach:

“I understand your time is valuable. Let me spend 10 minutes explaining how this can make a difference in your life.”

No interest? Thank attendees, gather feedback, and refine your presentation. Live webinars offer invaluable real-time responses that help you tweak your approach for higher conversions.

Why it works:

This funnel is perfect for selling consulting services or high-ticket products. By providing free value upfront, you build trust, making it easier to pitch your expertise during the webinar.

Each of these funnels has a unique approach but shares a common goal: guiding visitors seamlessly from curiosity to commitment. Whether it’s through personalized quotes, engaging webinars, or resourceful lead magnets, the key lies in understanding your audience’s needs and addressing them effectively. Start implementing these strategies today to convert traffic into long-term customers.

Final Thoughts: 3 Powerful Marketing Strategies Every Insurance Agent Needs to Know

Marketing is the lifeblood of success for any insurance agent. To achieve this, you must leverage three key strategies: building strong client relationships, harnessing the power of digital marketing, and establishing a unique personal brand. By doing so, you can position yourself as a trusted expert in the industry.

Moreover, consistency and authenticity are crucial. When you implement these strategies with a clear focus on delivering real value to your clients, not only will you grow your business, but you will also foster long-term trust and loyalty. Therefore, take the first step today, and watch your efforts gradually transform into meaningful connections and lasting success.